COMPOSITE MACRO ETF WEEKLY ANALYTICS (1/16/2016)

/LAYOUT (Organized by Time Period):

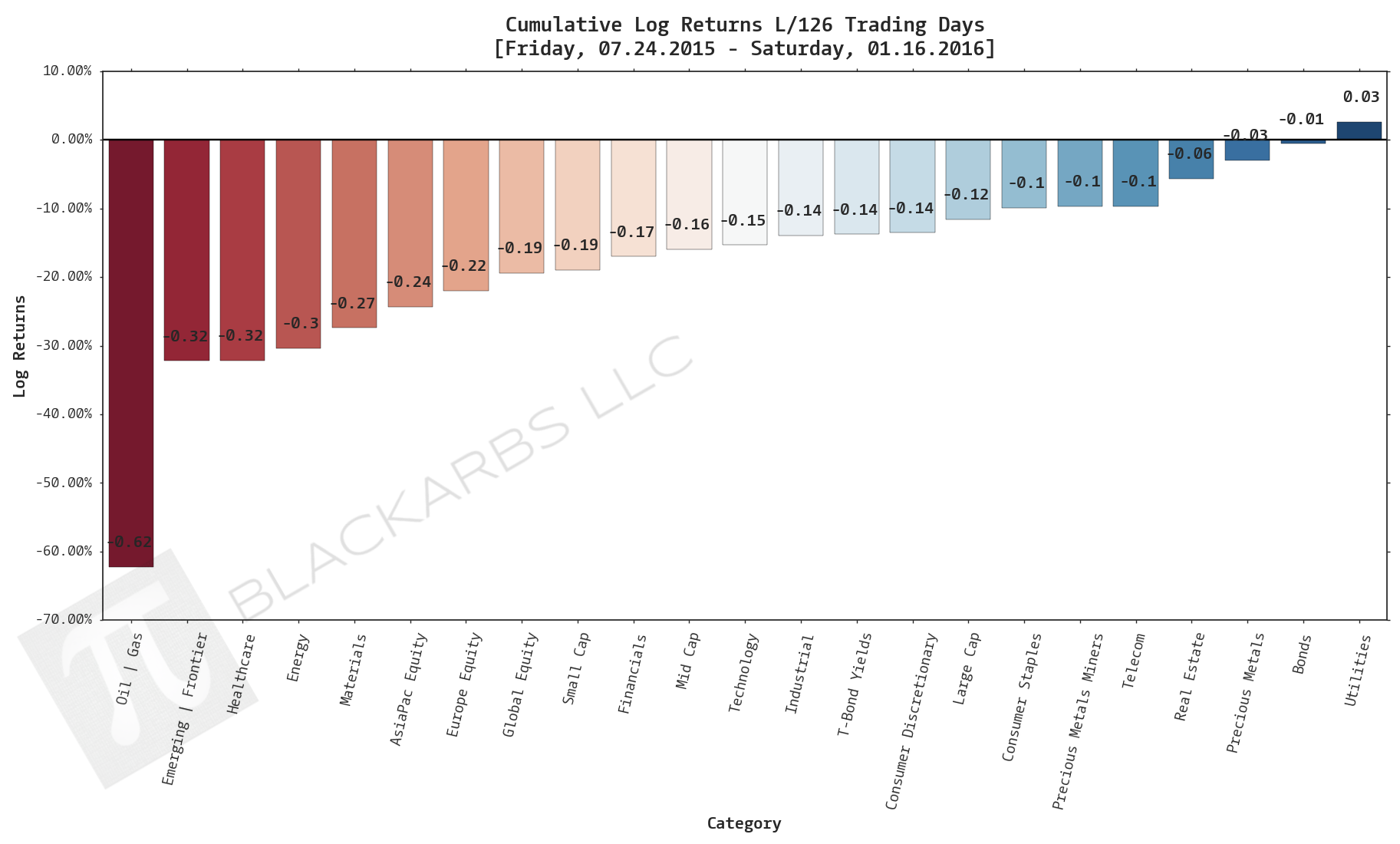

Composite ETF Cumulative Returns Momentum Bar plot

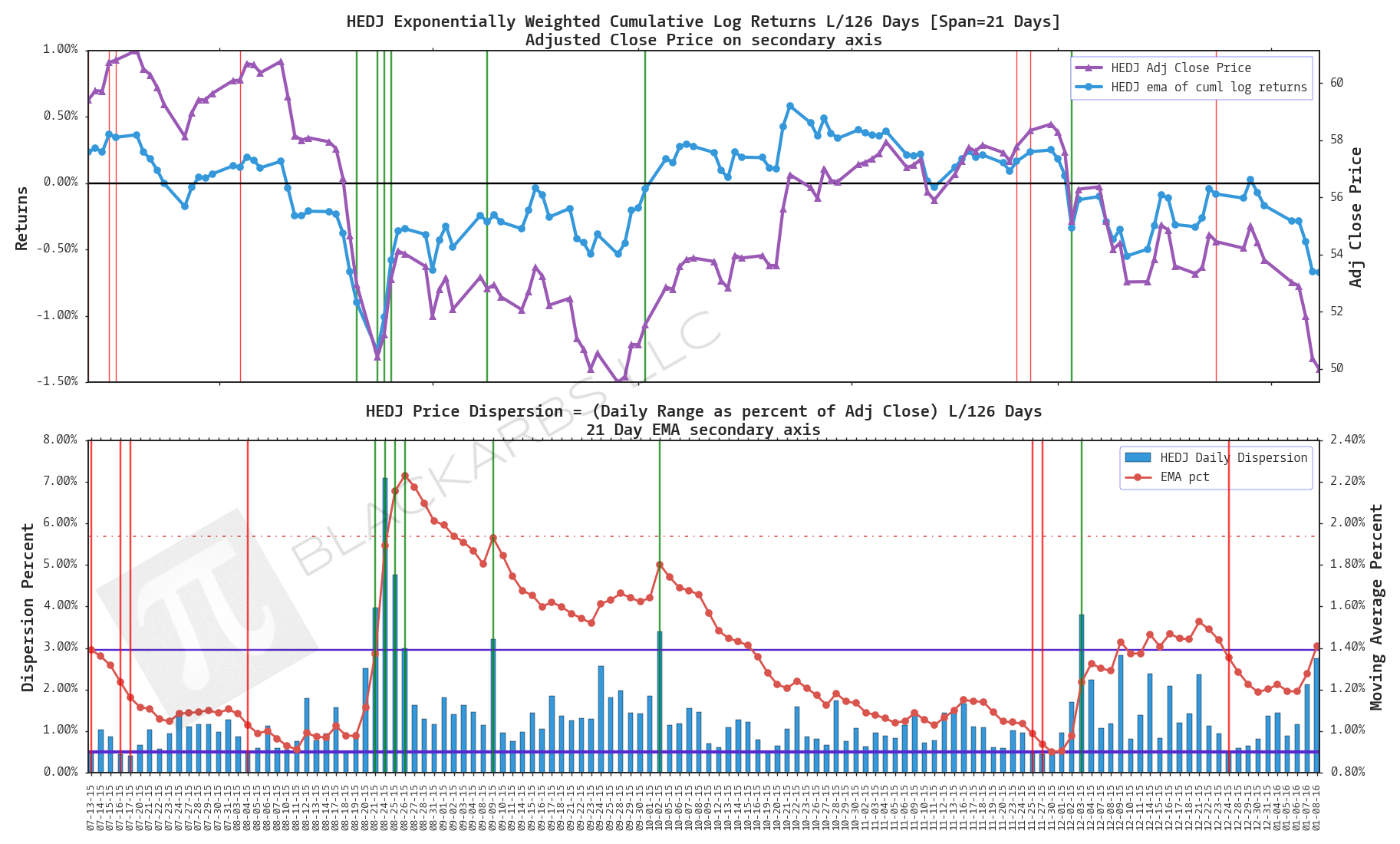

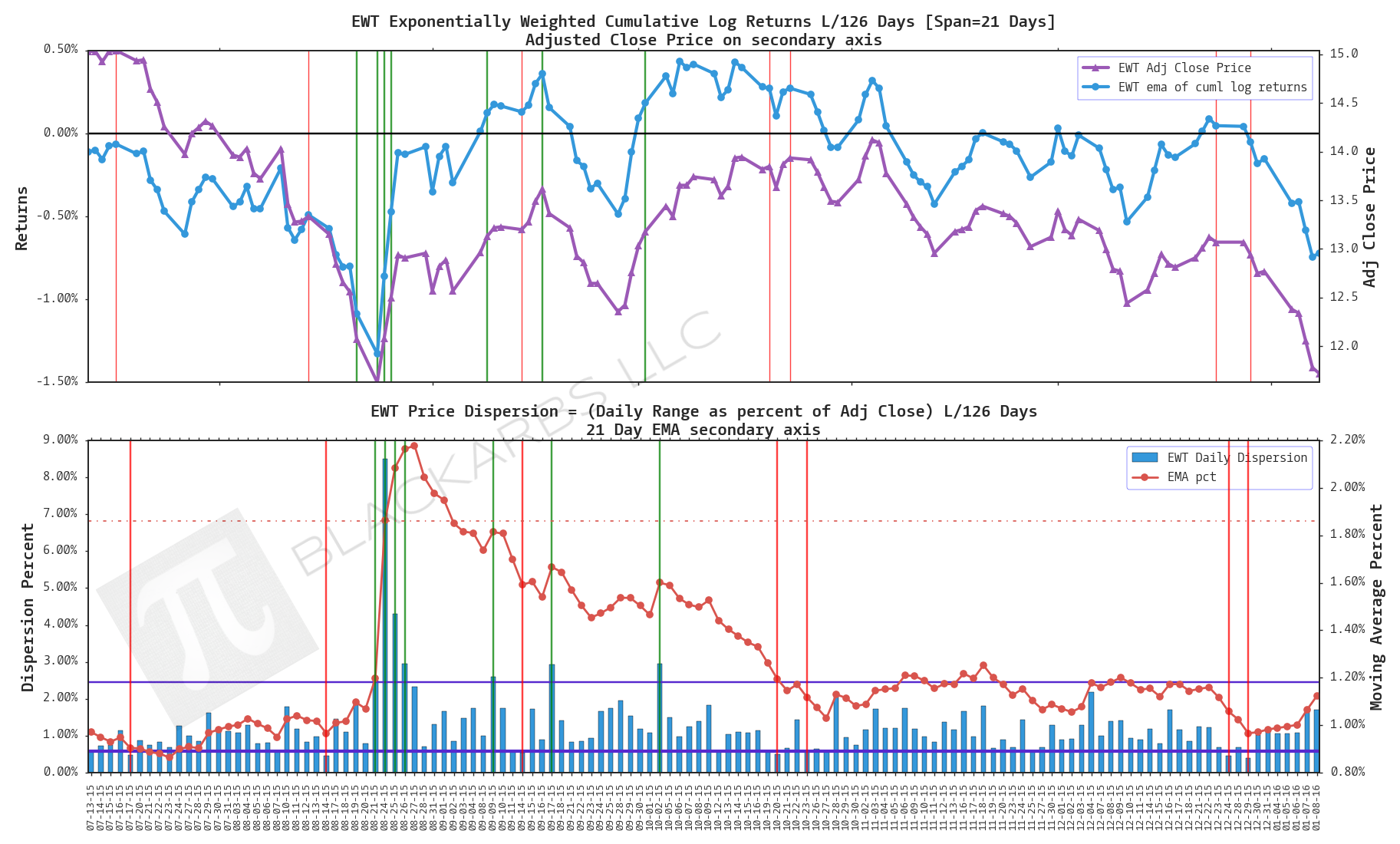

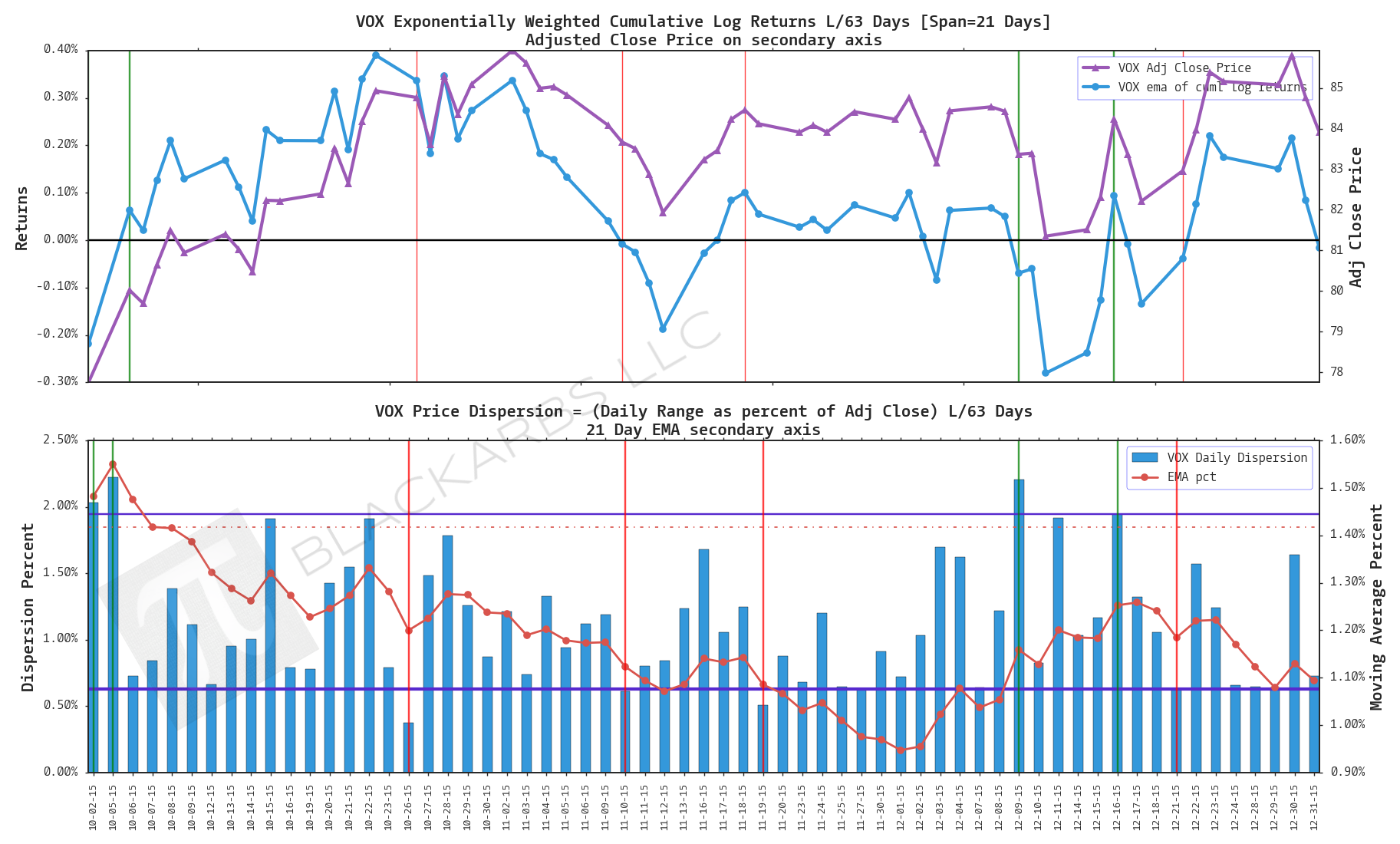

Composite ETF Cumulative Returns Line plot

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

LAST 126 TRADING DAYS

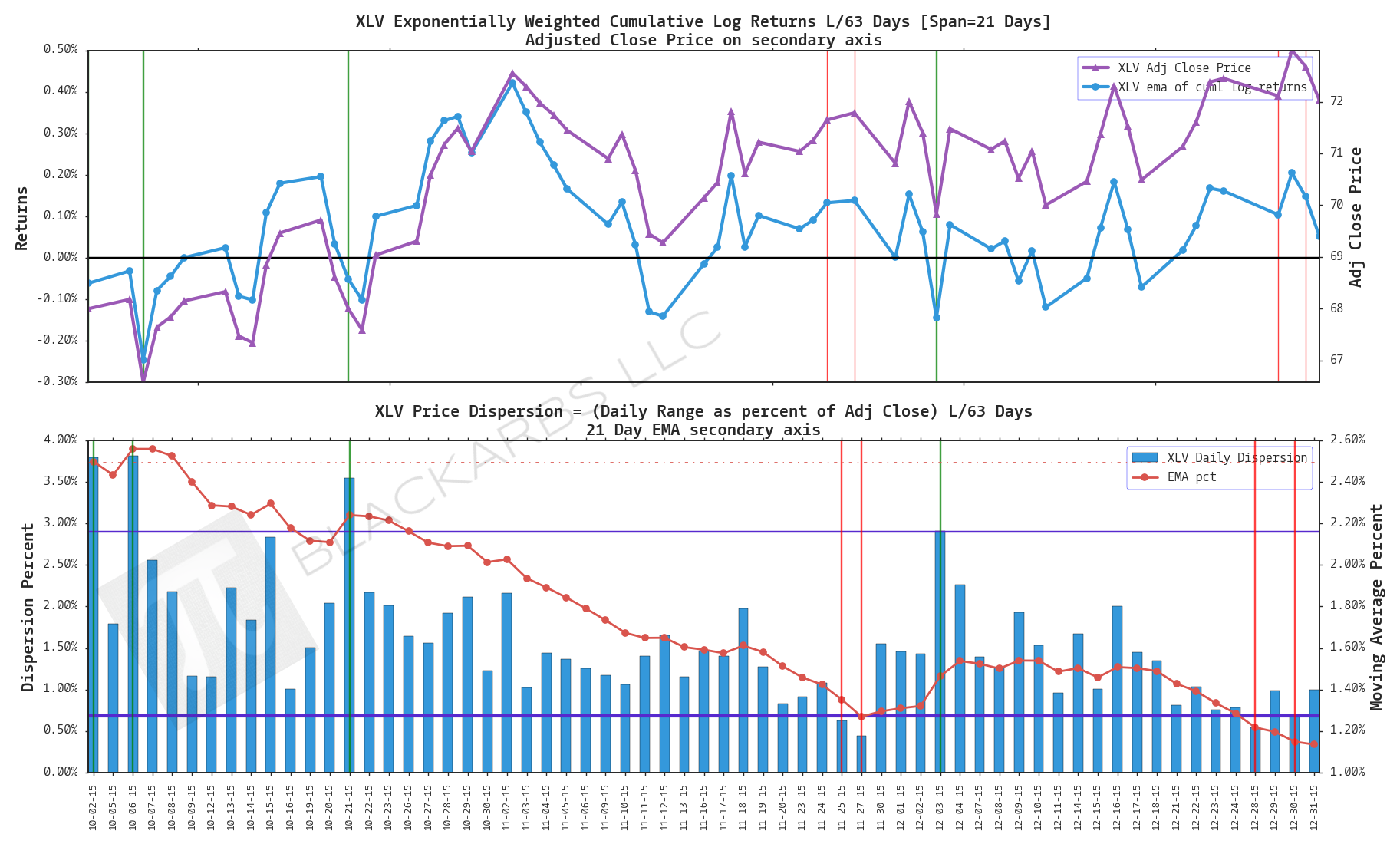

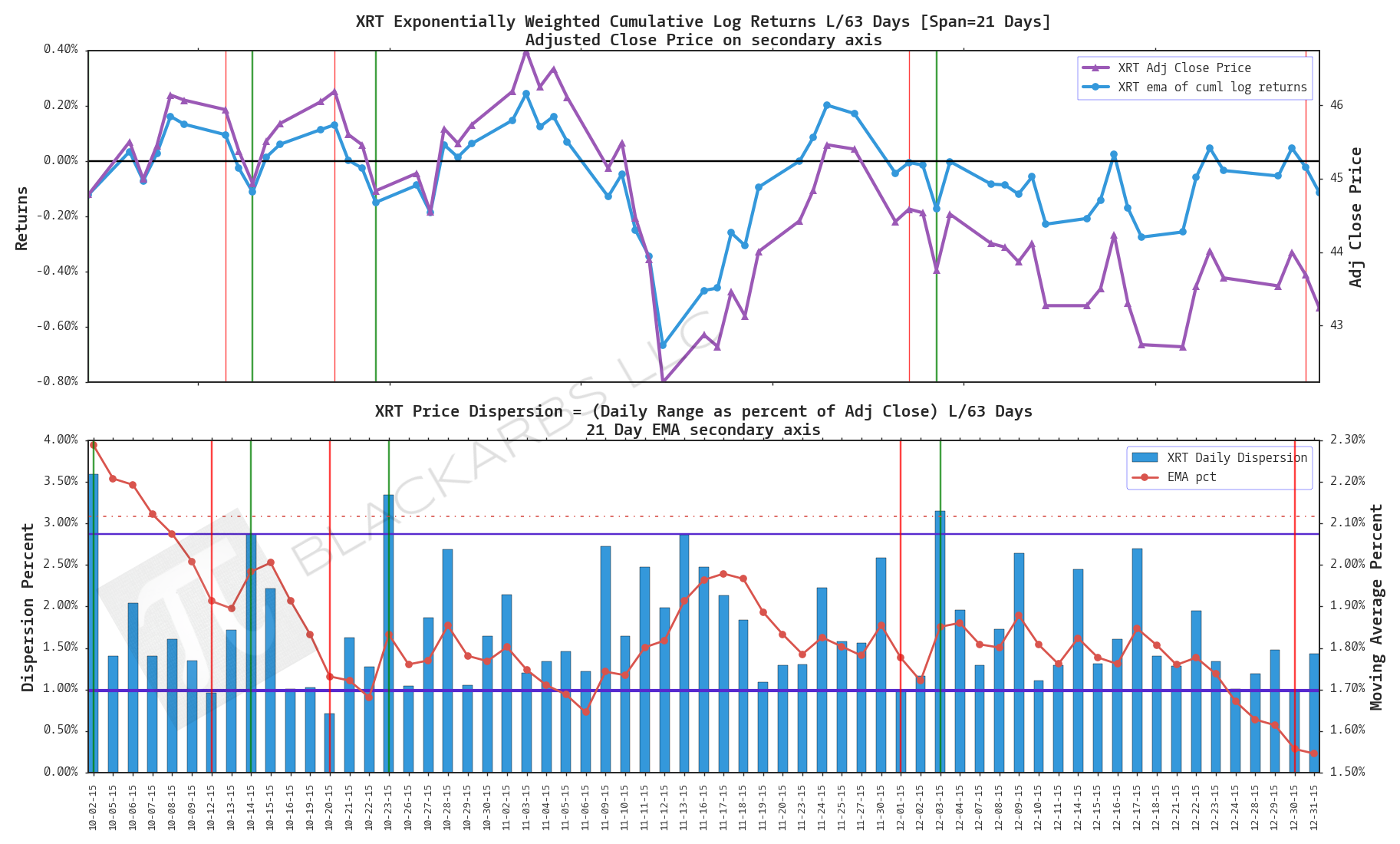

LAST 63 TRADING DAYS

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Cumulative Return Tables:

Notable Observations and Trends:

- Investors have been extremely defensive in recent trading as evidenced by Utilities, Bonds, and Precious Metals making the top 3 performers over the last 21, and 10 day periods.

- Only one composite has had positive cumulative returns over the last 252 days - Treasury Yields. If you're a long investor there have been very few ways to escape the selling outside of moving to cash.

- Flexible investors and traders are making a killing to the short side as selling has been very broad based across sectors.

- We are in a binary risk-on, risk-off phase of investing as evidenced by the increased correlations across sectors and the very high negative correlations of traditional safe havens/crash investments. (Bonds, Precious Metals + Precious Metals Miners)