COMPOSITE MACRO ETF WEEKLY ANALYTICS (4/02/2016)

/FOR A DEEPER DIVE INTO ETF PERFORMANCE AND RELATIVE VALUE SUBSCRIBE TO THE ETF INTERNAL ANALYTICS PACKAGE HERE

LAYOUT (Organized by Time Period):

Composite ETF Cumulative Returns Momentum Bar plot

Composite ETF Cumulative Returns Line plot

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Implied Cost of Capital Estimates

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

LAST 126 TRADING DAYS

YEAR-TO-DATE LAST 66 TRADING DAYS

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Implied Cost of Capital Estimates:

To learn more about the Implied Cost of Capital see here.

CATEGORY AVERAGE ICC ESTIMATES

ALL ETF ICC ESTIMATES BY CATEGORY

Cumulative Return Tables:

Notable Observations and Trends:

- The Precious Metals Miners composite has exploded over the last 126 and 66 days gaining ~+33, ~+37% respectively. That nearly doubles the next best performer for L/126 days and is just over 2.5x the second best performer over L/66 days.

- Precious Metals + Miners finally took a breath over the last 21 days as they lost ~ -3% and ~-2% respectively.

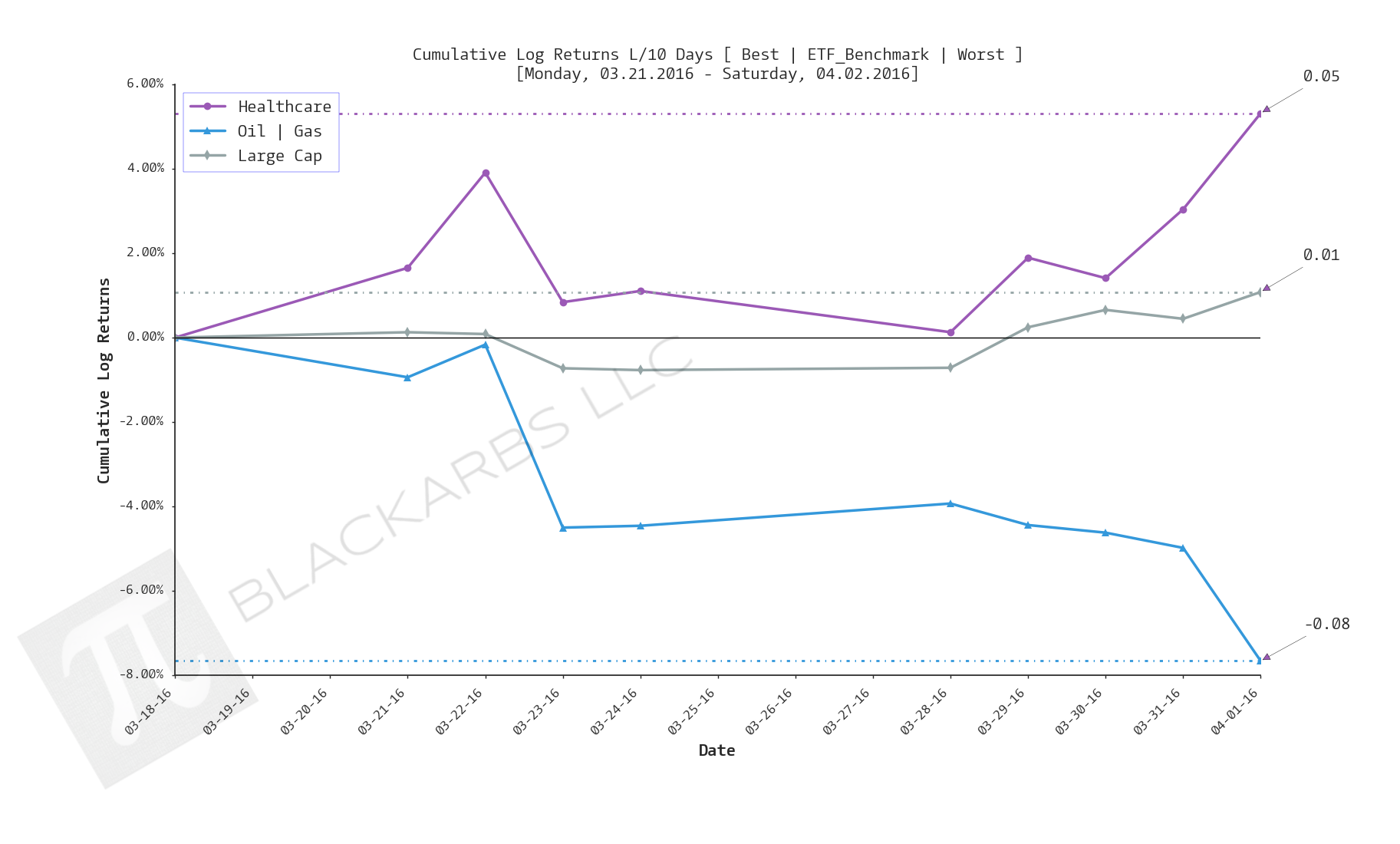

- Healthcare looks interesting again. It has been the third worst performer L/252 days losing investors almost -20%. Looking at the Best/Worst line plot L/66 days, Healthcare returns appear to have formed a base. Performance is positive since mid February 2016. Healthcare was the top performer L/10 days gaining ~+5%.

- Telecom has notable potential tailwinds. On a momentum basis the Telecom composite has been a top 3 performer for the L/252, L/126, L/10 days. On a fundamental basis, the ICC's of IXP and VOX are both >7% putting them in the upper half of investor's expected returns, compared to all ETFs.