Stocks - Post Earnings UPDATE (week of July 21, 2014)

/Let's take a look at how the previously graded stocks have performed over the last ~10 days.

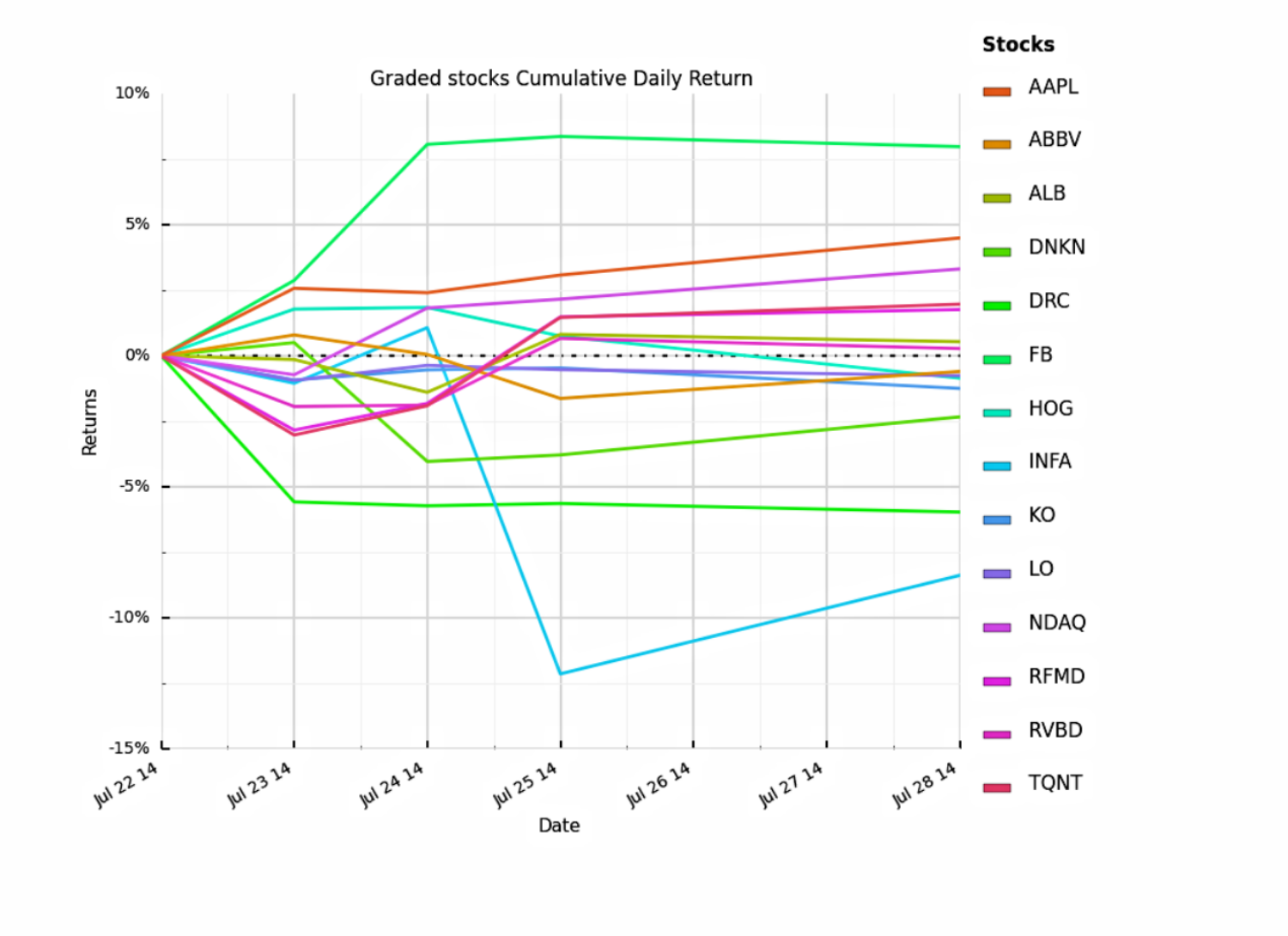

Please note this is a raw analysis in that these stocks reported at different times last week, so cumulative performance may be affected by the date they reported in addition to other factors.

The key take away for me regarding this chart is that most of the returns on this extremely short time scale cluster between +/- 5%. There are a couple relatively 'extreme' movements by this collection of stocks. Let's look at the next chart which allows for more detailed analysis.

First, for context the cumulative return for 'risky' assets is negative over the last 10 days. We can see this when using 'SPY' and 'HYG' as proxies for investors' risk appetite.

For reference the stocks with an 'Investment Prospect' grade ( iVC score > 60% ) included: AAPL, ABBV, ALB, ALGN, DRC, FB, HOG, INFA, LO, NDAQ;

Stocks with a 'Neutral' grade ( 45% <= iVC score <= 60% ) included: DNKN, KO, RFMD, RVBD;

Stocks with a 'Sell / Short Target' grade ( iVC score < 45% ) included: TQNT

Of the 10 stocks with an Investment Prospect grade only 5 have positive cumulative returns over this timespan. Admittedly I haven't updated all the grades (post earnings) for these firms yet but will be doing so over the next quarter. So, without knowing each of these firm's current guidance does the fact that the other 5 investment prospects have under performed mean they are now terrible stocks and my scoring process is garbage? Only time will tell. BUT...

...lets be clear only DRC, and INFA would have a blown a hole in your portfolio if you were long these stocks going into earnings. Surprisingly ALL of the other investment prospects have outperformed or remained within an approximate 1% cumulative decline which happens to mirror the returns of the broader market and other risky assets (SPY, HYG) during the same time frame. I'll chalk this up to a win for the preliminary Blackarbs 'iVC' grading process.

Now looking at the stock returns of the equities with a neutral grade we see the results are split! DNKN, and KO have declined while RFMD and RVBD have appreciated. This is actually a desired result and exactly what I would expect and hope to see in this context. Neutral grades mean we see no 'obvious' asymmetric risk:reward setups; or in other words, these stocks are or should be equally likely to appreciate or decline in value over some time span. Score another win for Blackarbs grading process.

Now let's look at TQNT which is the only equity with a failing or short target grade. Thus far TQNT has appreciated ~2% over this time period. This could be a function of two important factors one needs to consider during the investment process especially during earnings periods.

Investor expectations, and Industry.

Simply put a great company with a great stock could report stellar earnings but if the company fails to meet investor expectations the stock is likely to decline in the immediate aftermath. The same is true in reverse. TQNT registered one of the worst equity grades (18%) Blackarbs has recorded thus far which could be an indicator that, while the company is clearly struggling, investor expectations are (could be) at their lowest. Therefore ANY positive results from the earnings report could act as a catalyst for the stock to appreciate. The second factor of importance is the industry the firm operates in. TQNT is a semiconductor company. If you have been following the markets you know that this is one of the *hottest* and strongest performing sub-industries of the Technology sector this year. The expression 'a rising tide lifts all boats' is applicable here. In the short term both of these factors could be contributing to the TQNT's short term outperformance. Only time will tell with this one. So far this is a loss for the grading scale with an opportunity to become a win.

Preliminary Blackarbs IVC grades are 2/3 thus far. I like the start and will look to continue this feature moving forward.