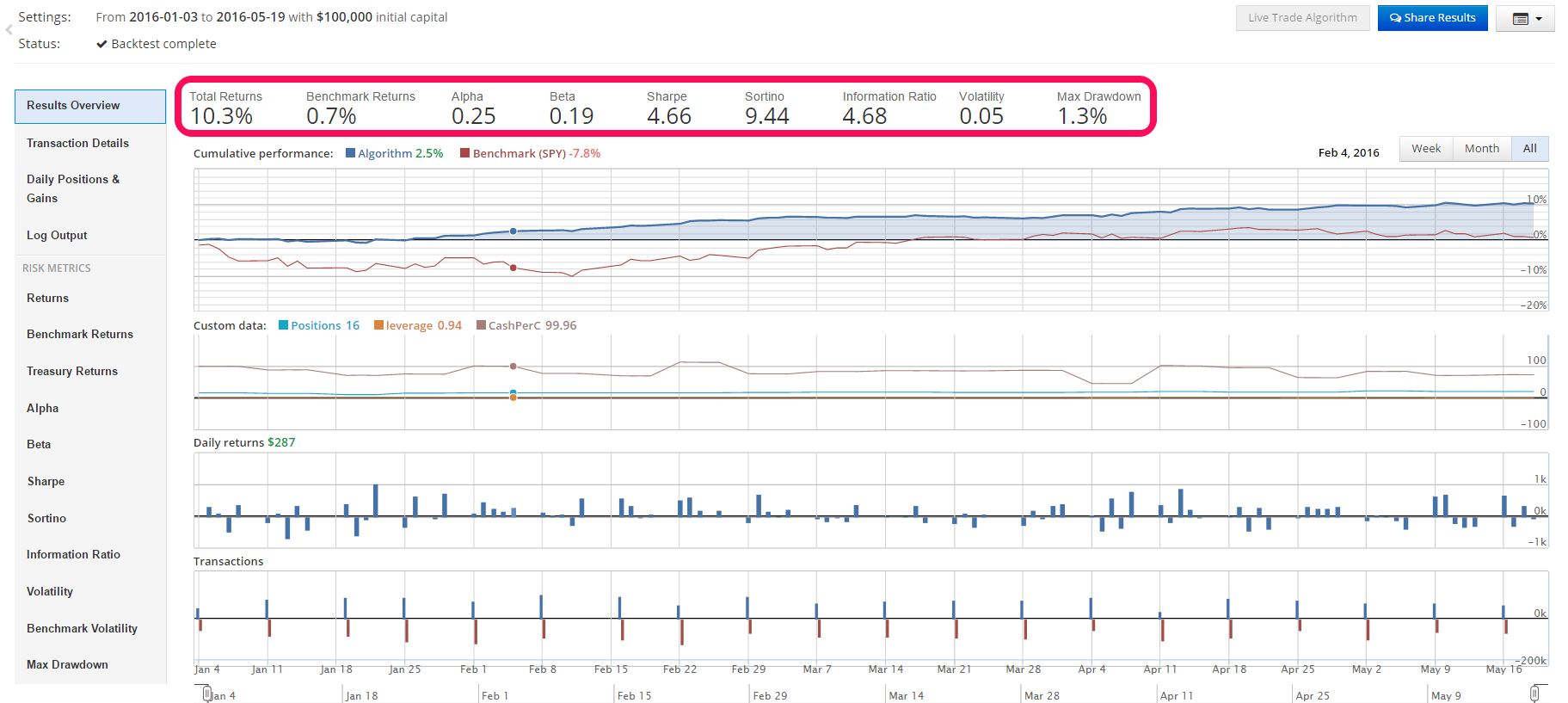

BACKTESTING THE IMPLIED VOLATILITY STRATEGY WITH QUANTOPIAN (5/20/16)

/We are now 19 weeks into testing this strategy and the results are strong. Since the last published backtest, the volatility of the strategy has declined from 6% to 5%, beta has declined from 0.20 to 0.19. Alpha has increased from 19% to 25%. The Sortino and Information Ratios have increased from 6.41, and 1.63 to 9.44 and 4.68 respectively. On an absolute return basis the strategy is crushing the SPY benchmark, 10.3% to 0.7%.

Read More