FOR A DEEPER DIVE INTO ETF PERFORMANCE AND RELATIVE VALUE SUBSCRIBE TO THE ETF INTERNAL ANALYTICS PACKAGE HERE

To see the origin of this series click here.

To summarize, the strategy calculates a SKEW measure using ATM calls and OTM puts for a collection of ETF symbols. It then sorts the symbols into quintiles based on the SKEW factor.

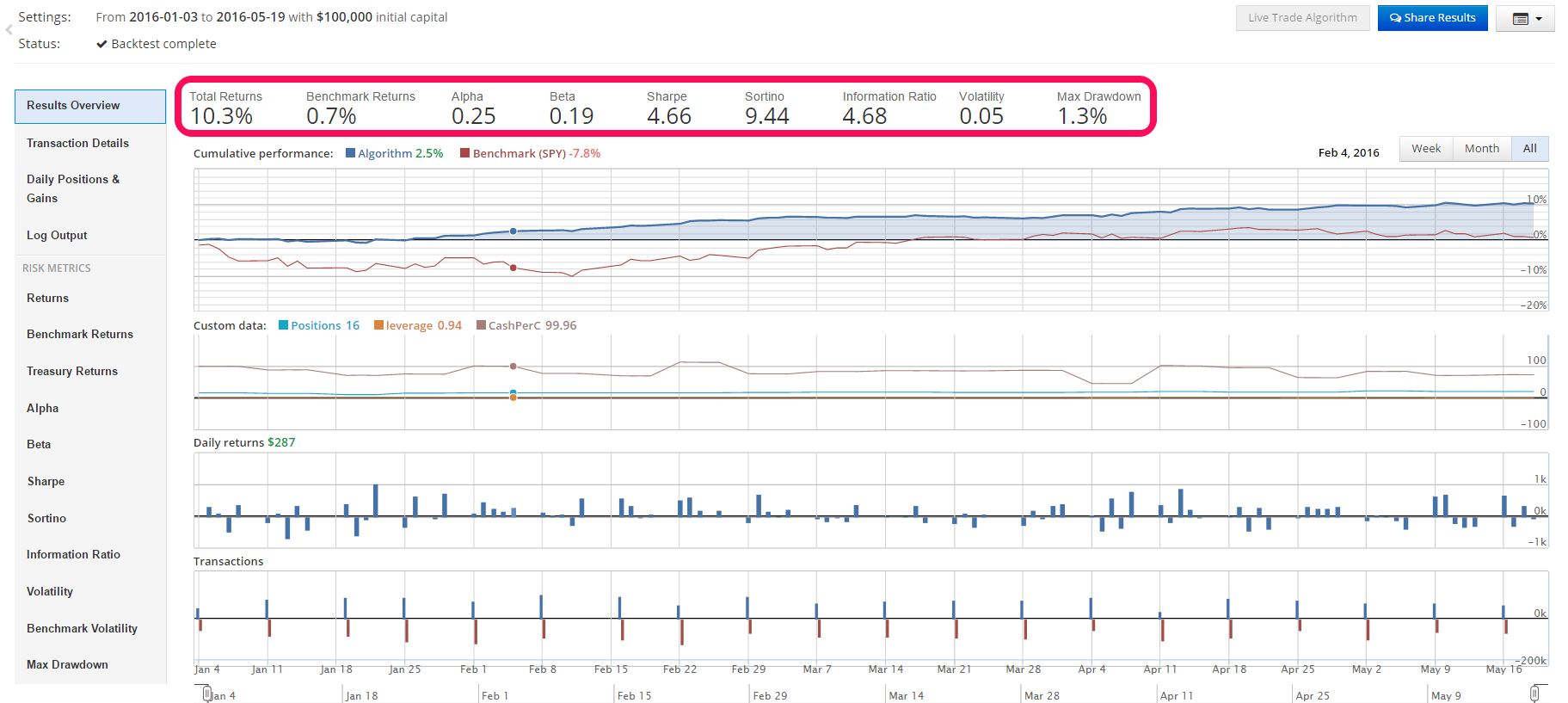

Using daily close/close log return calculations for this strategy has shown exceptional performance as can be seen here. However, translating a successful daily strategy with no transaction costs and perfect trading fills into a robust strategy that can execute and perform well after incorporating the real structure of market trading is a difficult task. In some cases the strategy cannot survive this translation.

In order to test the viability of this strategy I used the Quantopian platform, which allows event-based point-in-time simulated trading on real market data. It also allows us to model transaction costs and slippage which can have large impacts depending on the strategy.

The following backtest is a variation on the original strategy proposed in the series. This strategy does the following:

- Calculate the SKEW factor using options data and implied volatility for selected ETFs.

- Sort the ETFs according to the SKEW factor and divide into quintiles.

- Go long the ETFs in top quintile while shorting the ETFs in the bottom quintile.

- The strategy is equal weight and market-neutral.

- Holding period is one week.

- Trades are initiated on the first day of the week 20 minutes prior to the market close.

- Rebalancing/liquidation occurs on the first day of the trading week 5 minutes after the market open.

- The portfolio size is $100,000 USD.