COMPOSITE MACRO ETF WEEKLY ANALYTICS (1/30/2016)

/LAYOUT (Organized by Time Period):

Composite ETF Cumulative Returns Momentum Bar plot

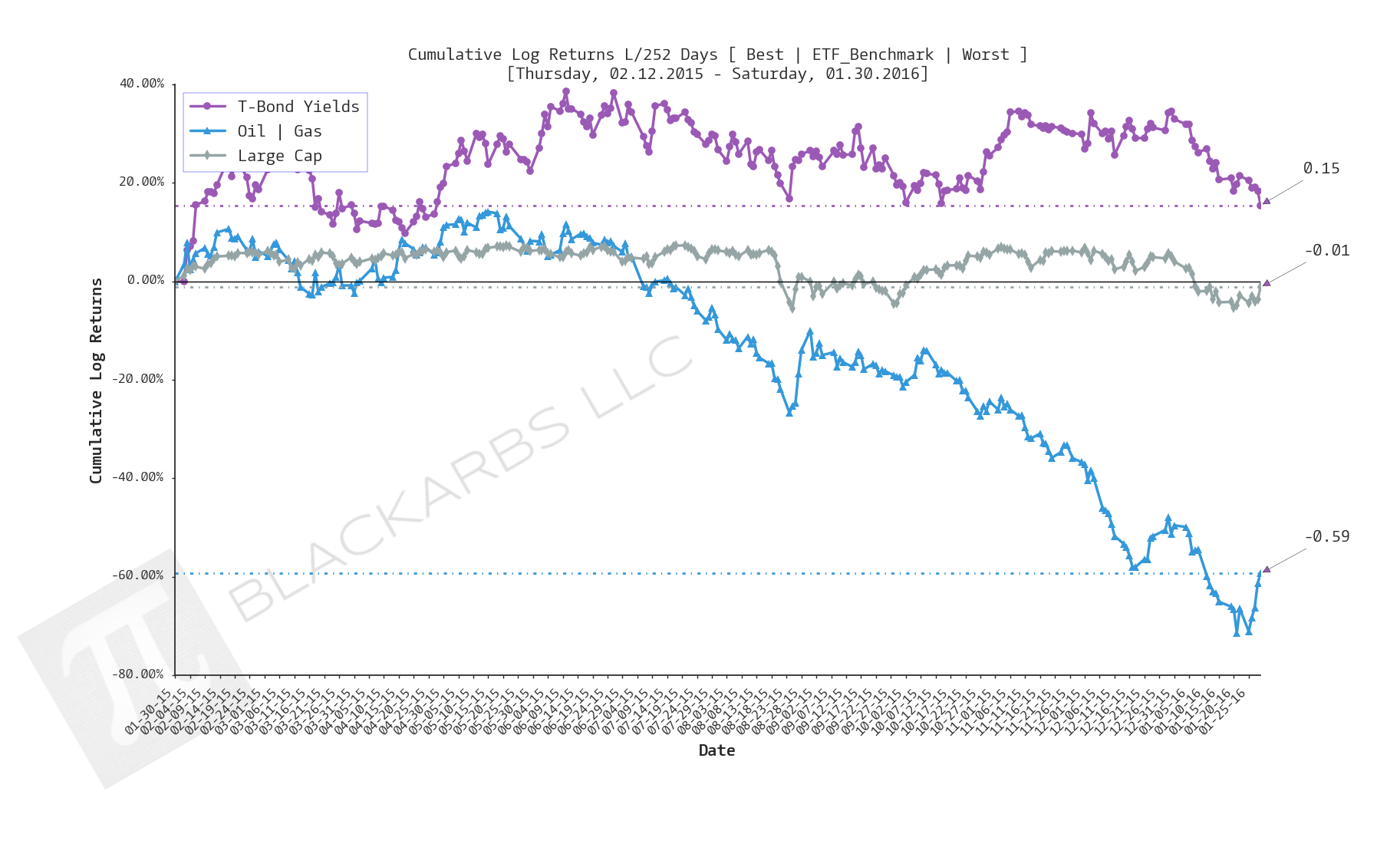

Composite ETF Cumulative Returns Line plot

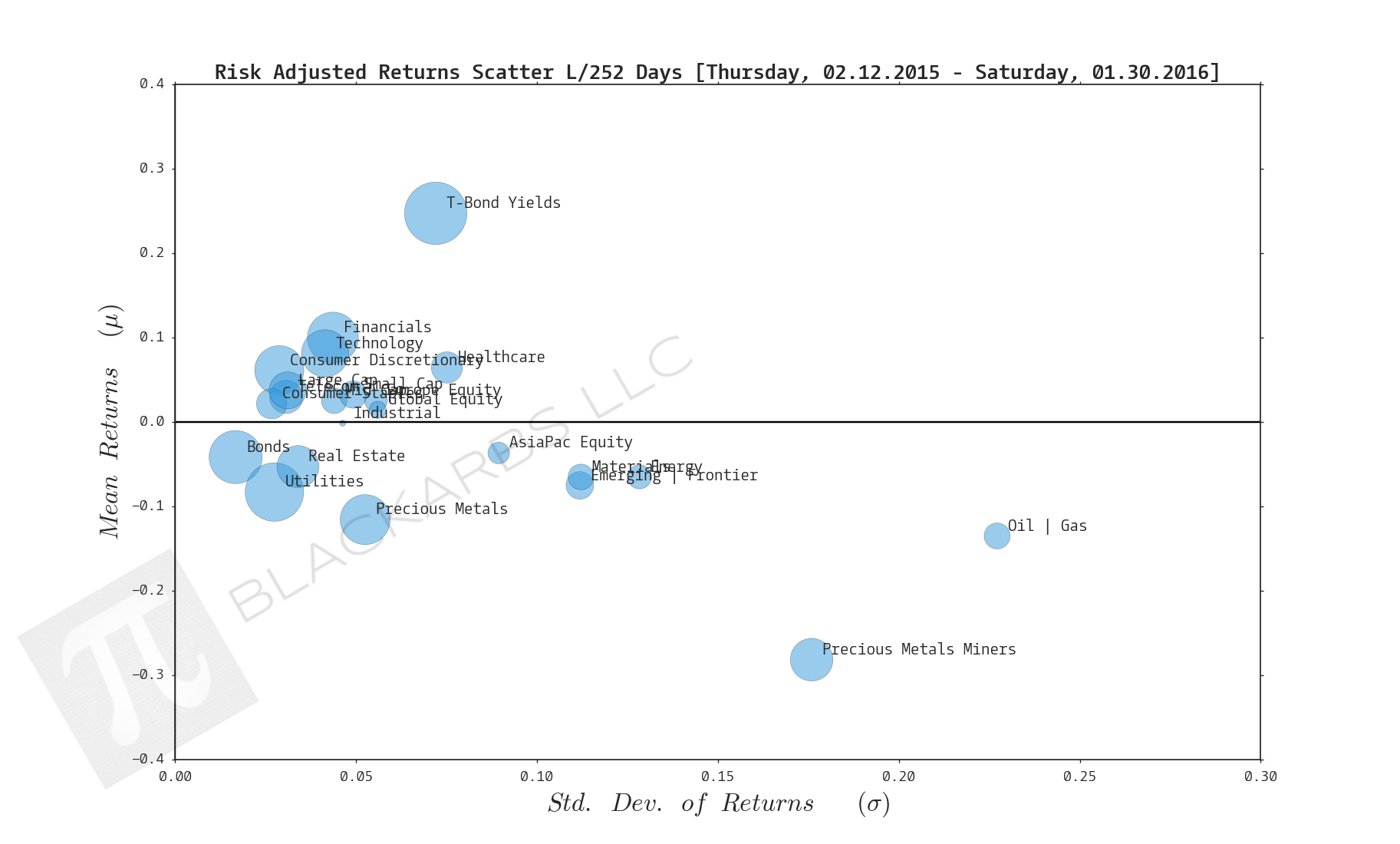

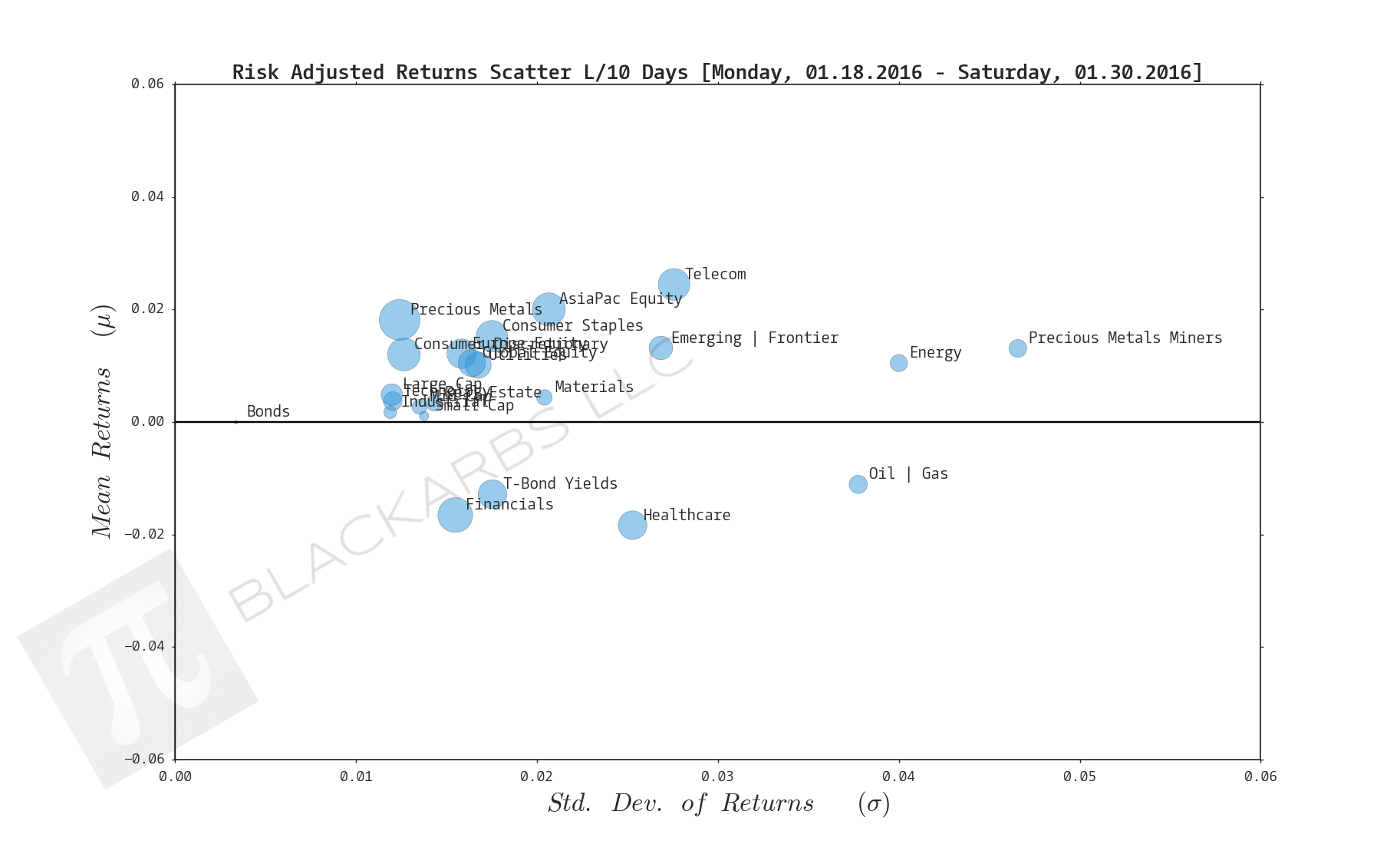

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Cumulative Return Tables:

Notable Observations and Trends:

- Last 10 days provides strong evidence of a relief rally as all but 2 composites showed positive cumulative gains. Further evidence is the leadership group comprised of Energy, Precious Metals Miners, and Emerging/Frontier which had been heavily oversold on a long and medium term basis.

- Additionally over the Last 10 days one of the worst 3 performers (Bonds) had positive performance.

- Telecom has emerged as a composite to watch being one of the top 3 performers over the last 252 days. Perhaps it is the new safe haven asset class as it has been a top 5 performer on all time frames under study.

- Telecom has also been a strong performer on a risk-adjusted basis seemingly hugging the belly of the efficient frontier, near or above zero, across all time frames.