COMPOSITE MACRO ETF WEEKLY ANALYTICS (12/19/2015)

/LAYOUT (Organized by Time Period):

Composite ETF Cumulative Returns Momentum Bar plot

Composite ETF Cumulative Returns Line plot

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

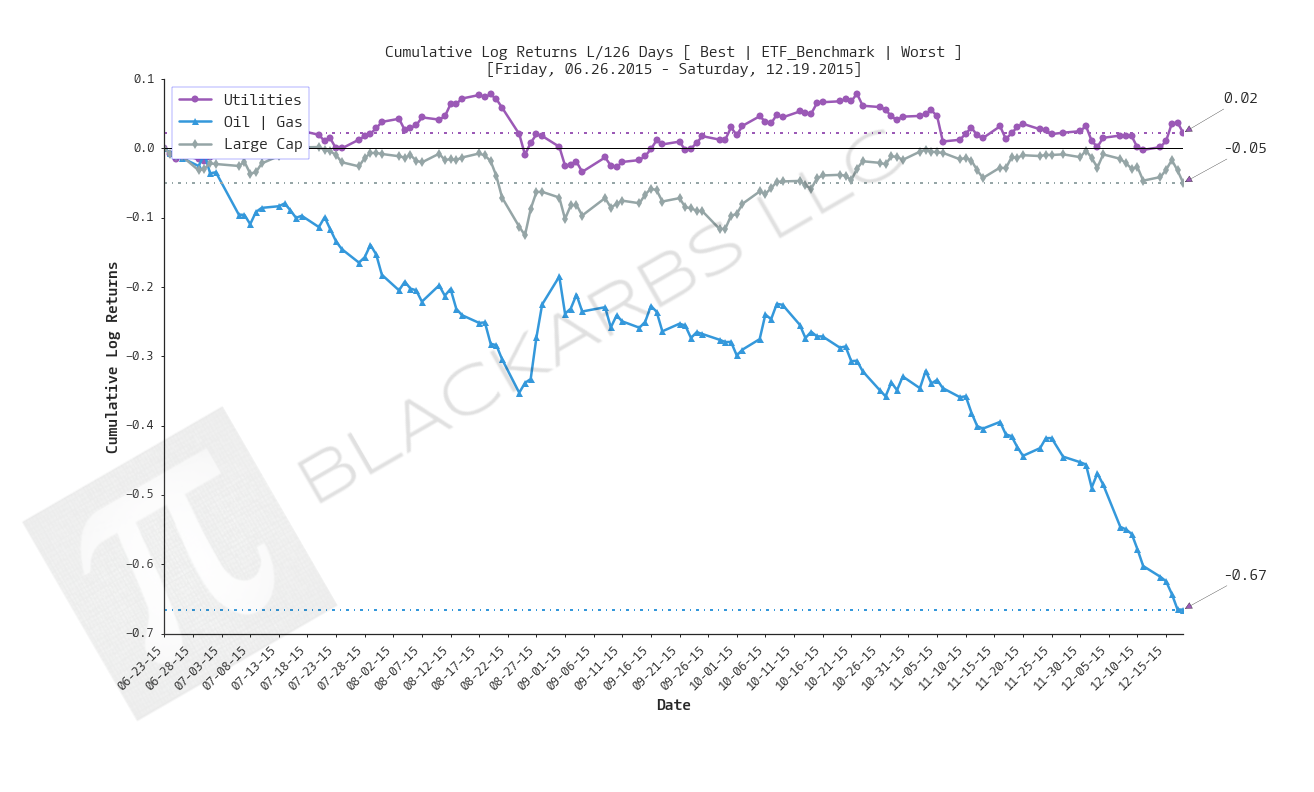

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Cumulative Return Tables:

Notable Observations and Trends:

- The Healthcare composite has shown the most durable positive, relative performance of the groups. It has been a top 3 performer over the last 252, 21, 10 trading day periods.

- Over the last 63 trading days Treasury bond yields have been the number 1 performer. If Treasury yields continue to outperform, it's likely that any selloff in equities will reverse course.

- Energy and Oil + Gas continue to underperform across time periods with no end in sight.

- Precious Metals Miners are also hurting over the last 252, 126 and 63 day time frames. I wonder if, at some point a bullish case could be made given that their largest input (Oil and Gas) continue to decline in price.

- It's interesting that over the last 21 trading day period there were no composite groups with positive cumulative returns.