COMPOSITE MACRO ETF WEEKLY ANALYTICS (1/02/2016)

/LAYOUT (Organized by Time Period):

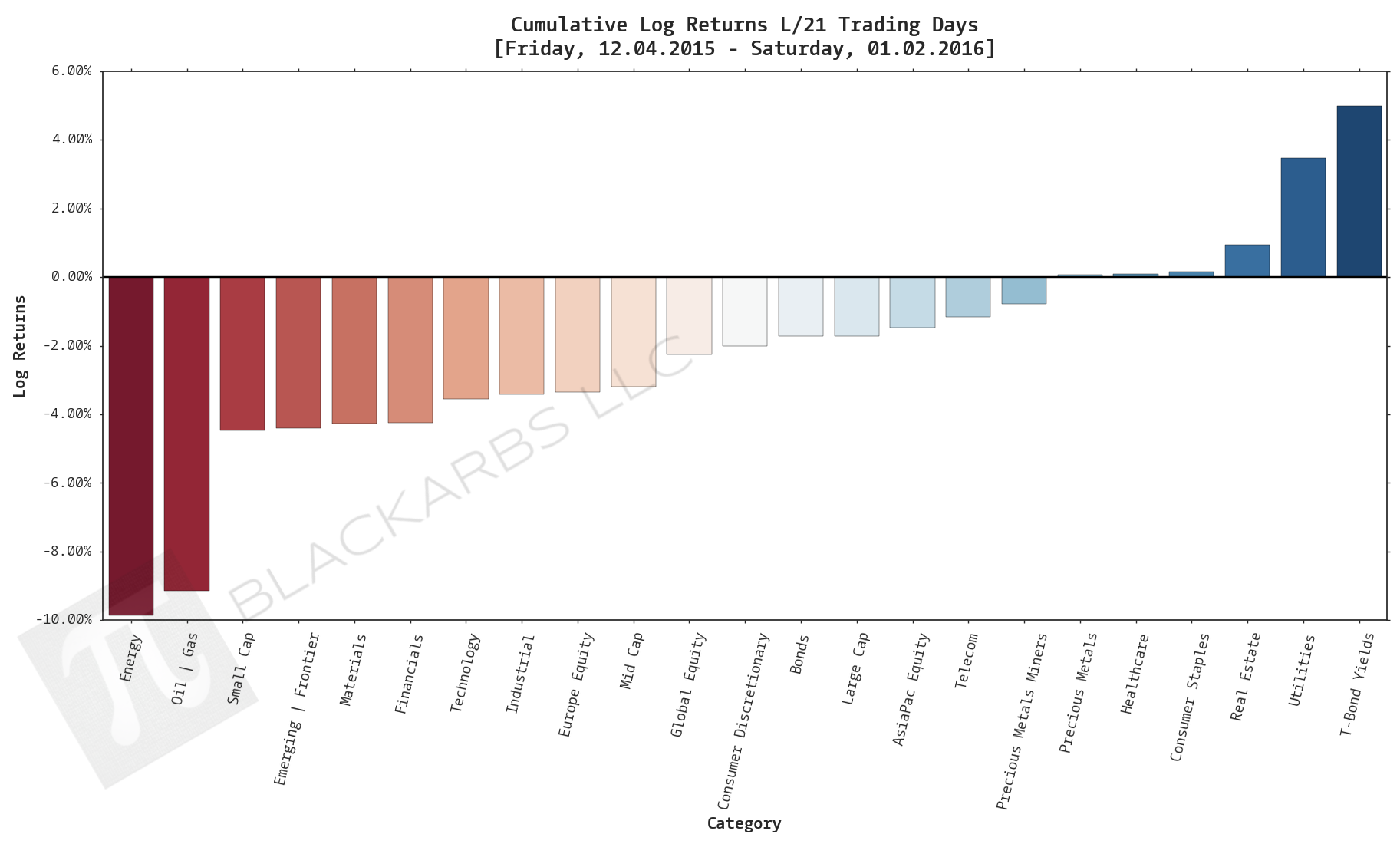

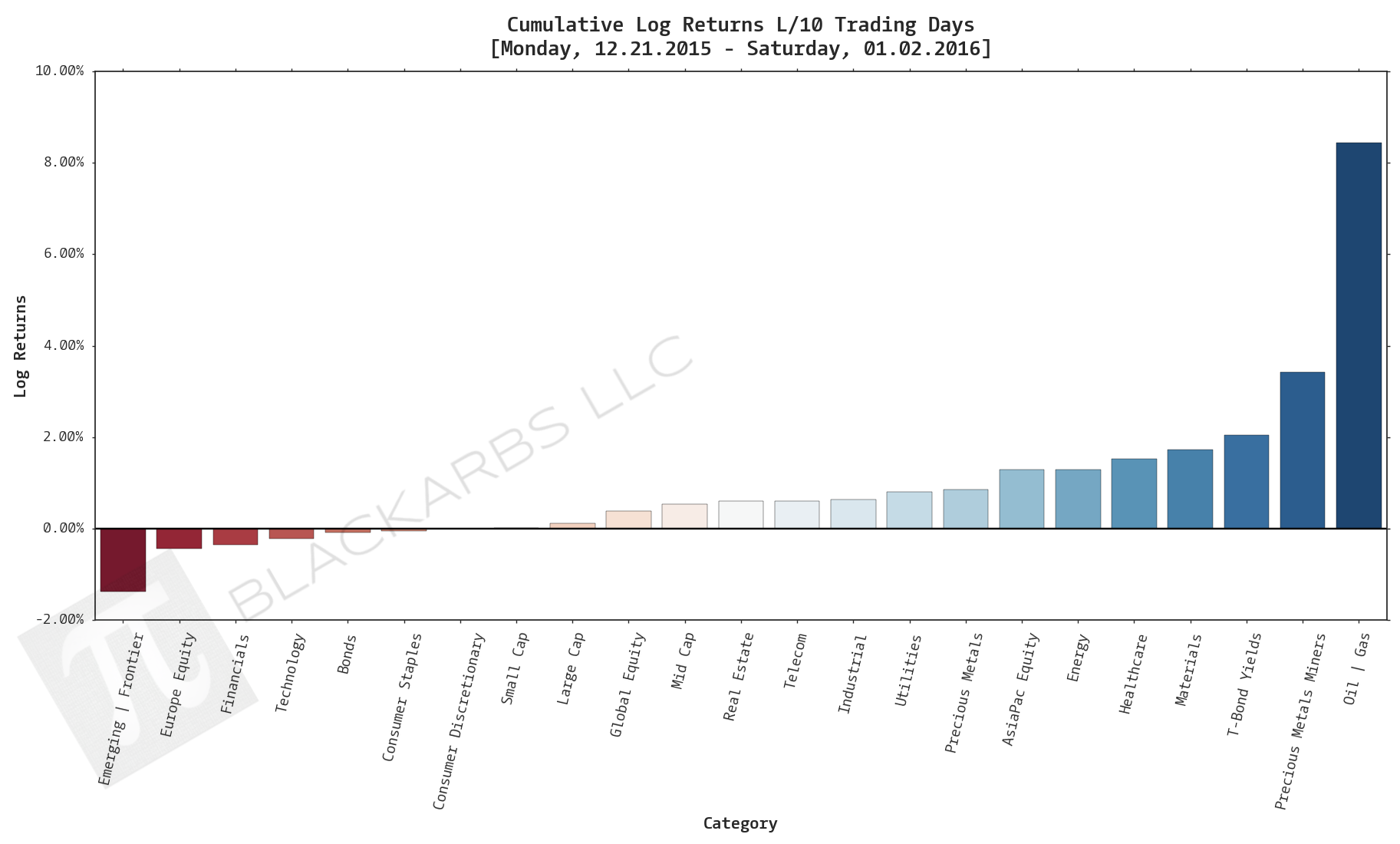

Composite ETF Cumulative Returns Momentum Bar plot

Composite ETF Cumulative Returns Line plot

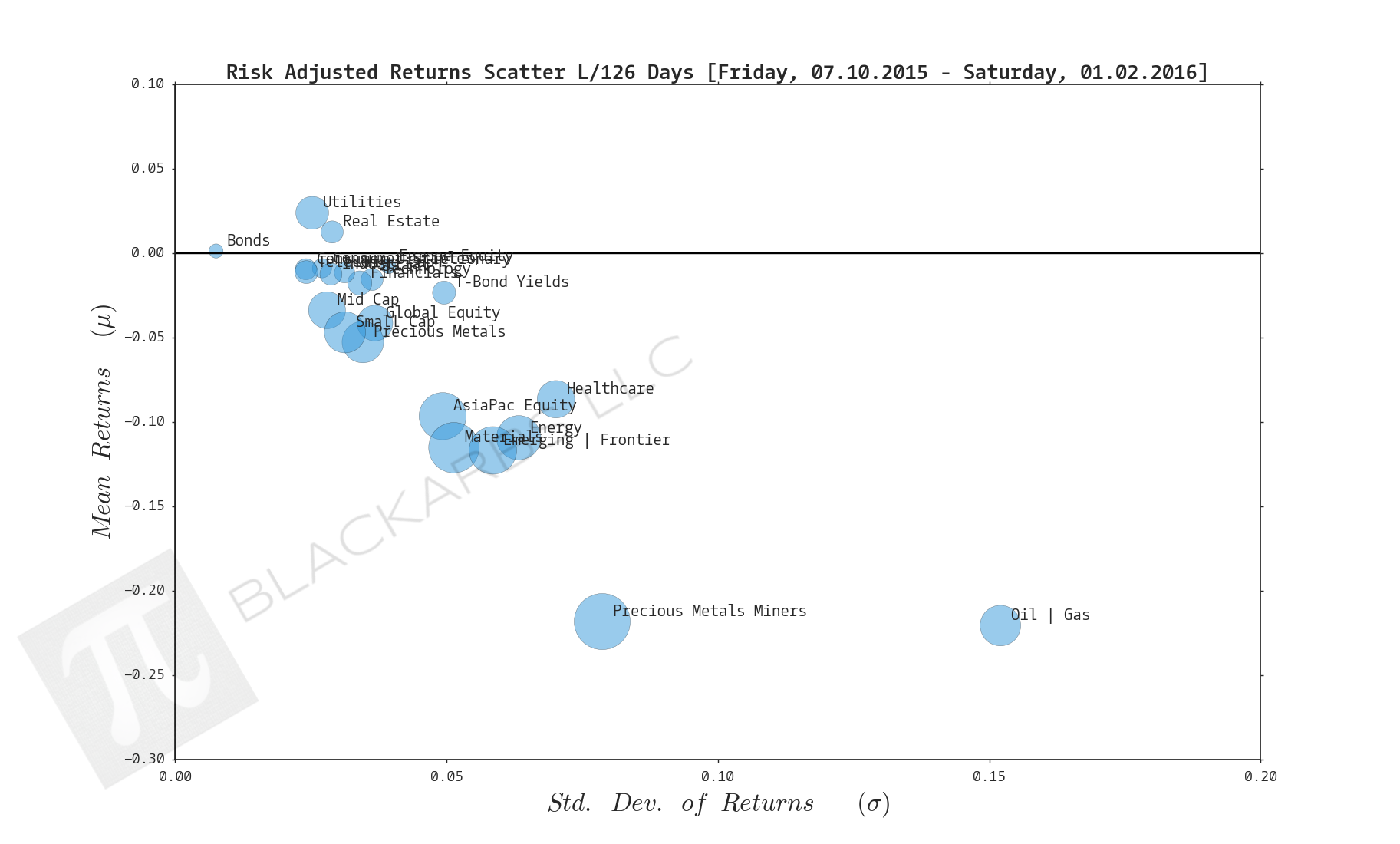

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

LAST 21 TRADING DAYS

LAST 10 TRADING DAYS

Cumulative Return Tables:

Notable Observations and Trends:

- T-Bond Yields have positive cumulative returns on all time frames. This appears to be a one way trade given the prior belief and subsequent start of rate tightening by the Federal Reserve.

- As noted last week, Oil + Gas and Precious Metals Miners may be experiencing a bit of a relief rally as traders/investors cash in on their short plays and/or try to time a bottom.

- Examining the Scatter plots over the last 252 days Healthcare is the best risk-adjusted composite and it's not even close.

- Interesting to note the Small Caps composite makes an appearance on the bottom 3 worst performers over the last 21 days.