COMPOSITE MACRO ETF WEEKLY ANALYTICS (2/20/2016)

/FOR A DEEPER DIVE INTO ETF PERFORMANCE AND RELATIVE VALUE SUBSCRIBE TO THE ETF INTERNAL ANALYTICS PACKAGE HERE

LAYOUT (Organized by Time Period):

Composite ETF Cumulative Returns Momentum Bar plot

Composite ETF Cumulative Returns Line plot

Composite ETF Risk-Adjusted Returns Scatter plot (Std vs Mean)

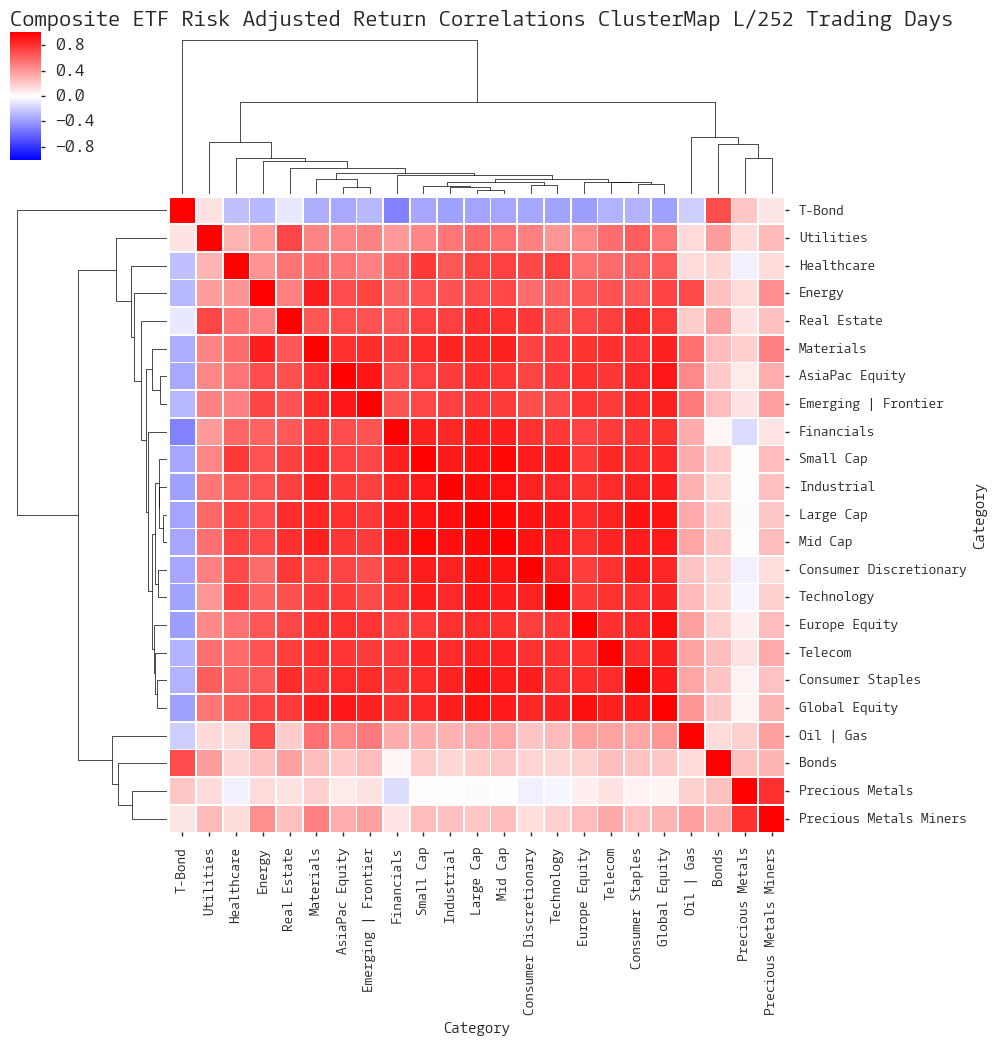

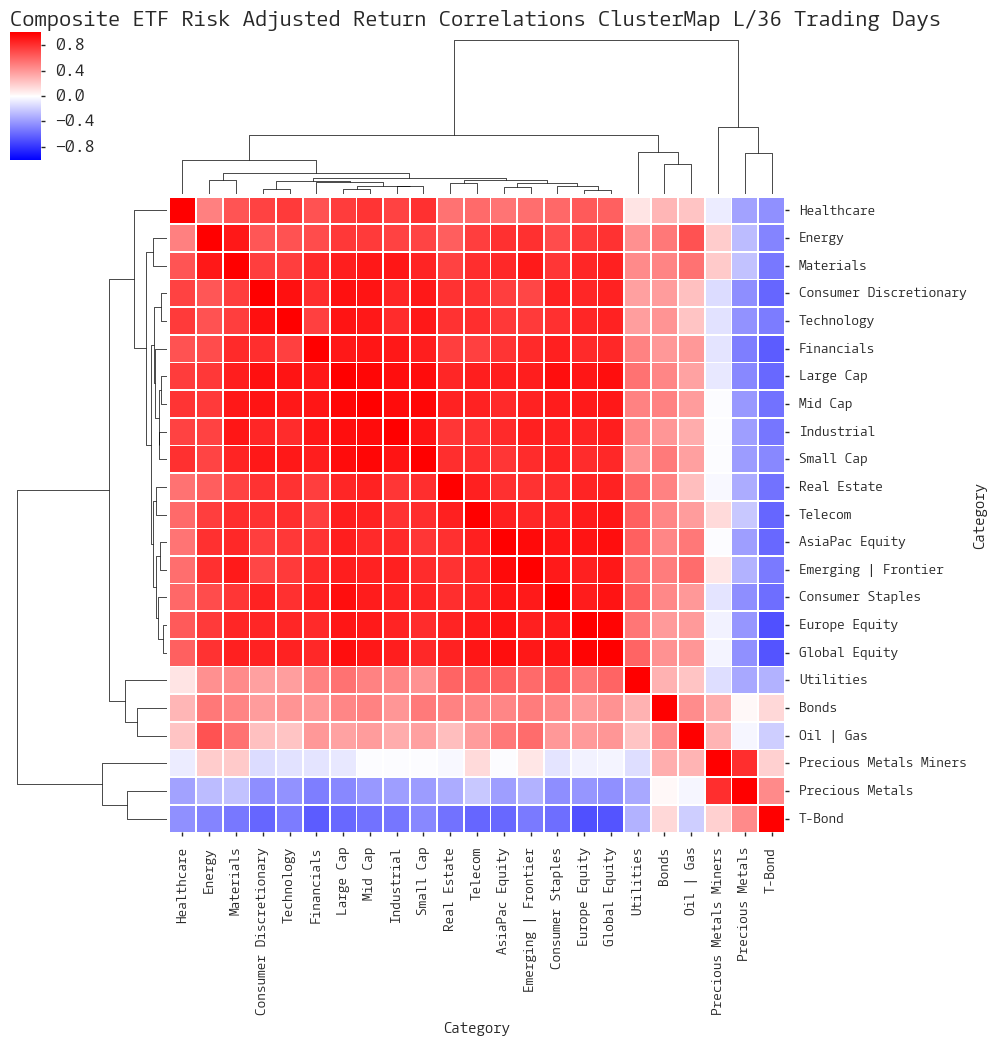

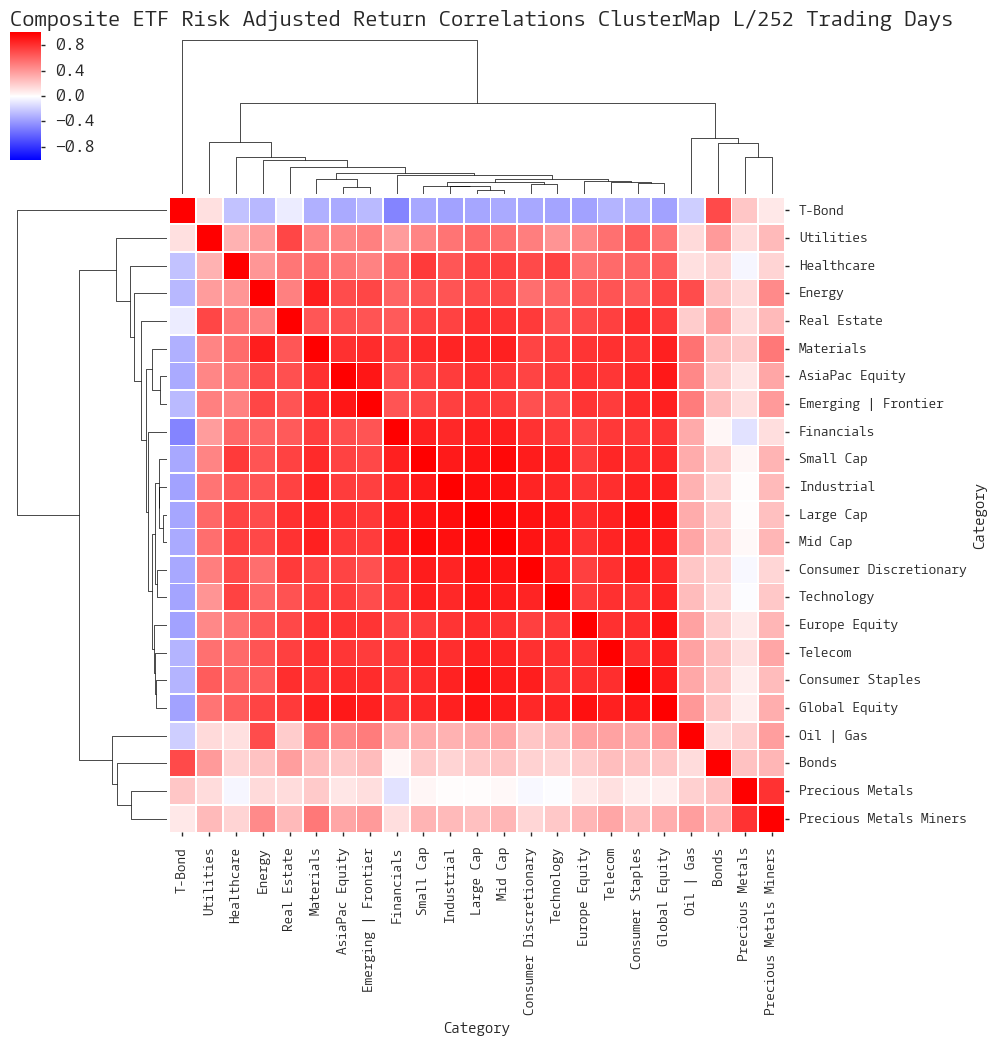

Composite ETF Risk-Adjusted Return Correlations Heatmap (Clusterplot)

Implied Cost of Capital Estimates

Composite ETF Cumulative Return Tables

Notable Trends and Observations

COMPOSITE ETF COMPONENTS:

LAST 252 TRADING DAYS

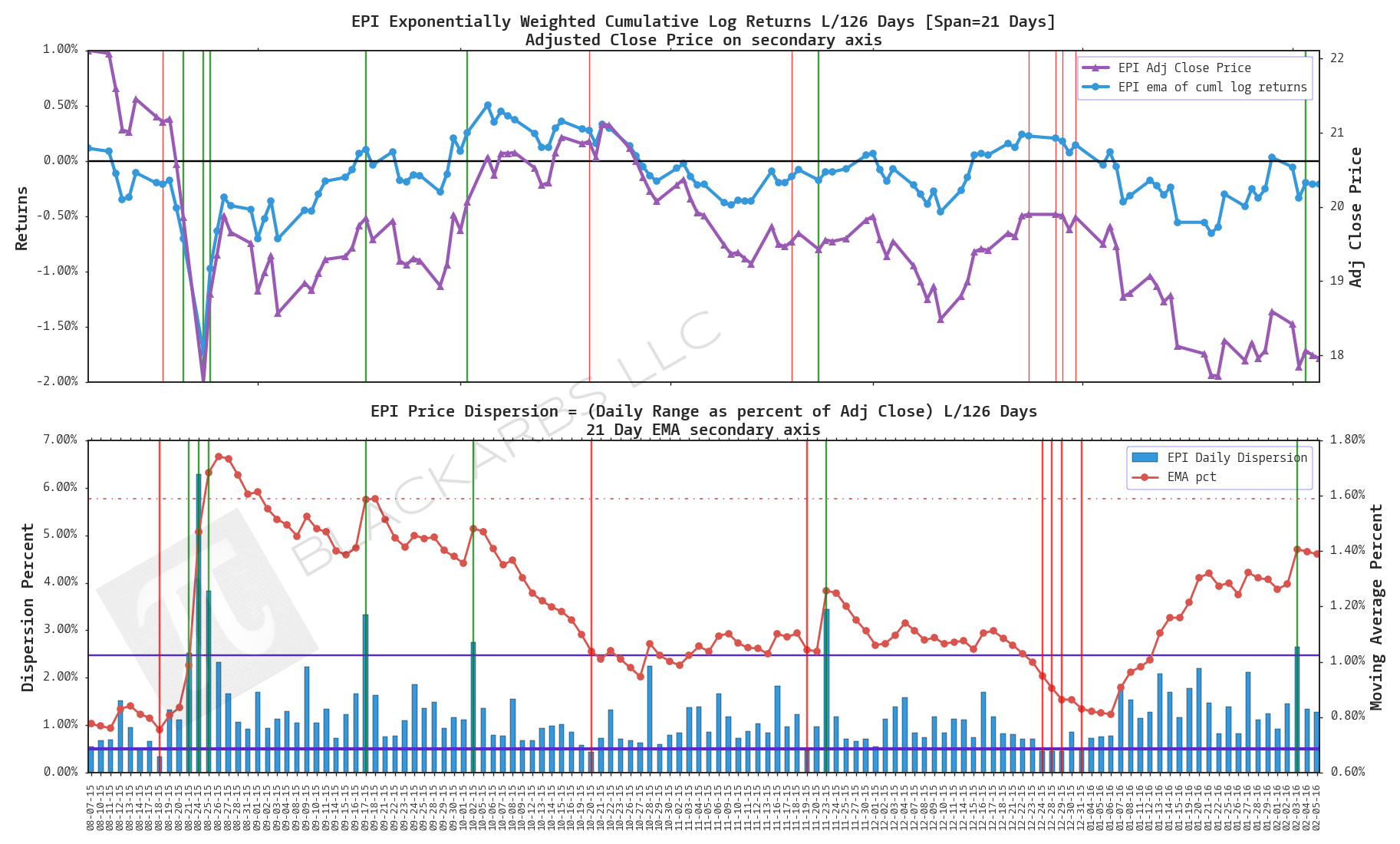

LAST 126 TRADING DAYS

LAST 63 TRADING DAYS

Year-to-date LAST 36 TRADING DAYS

LAST 21 TRADING DAYS

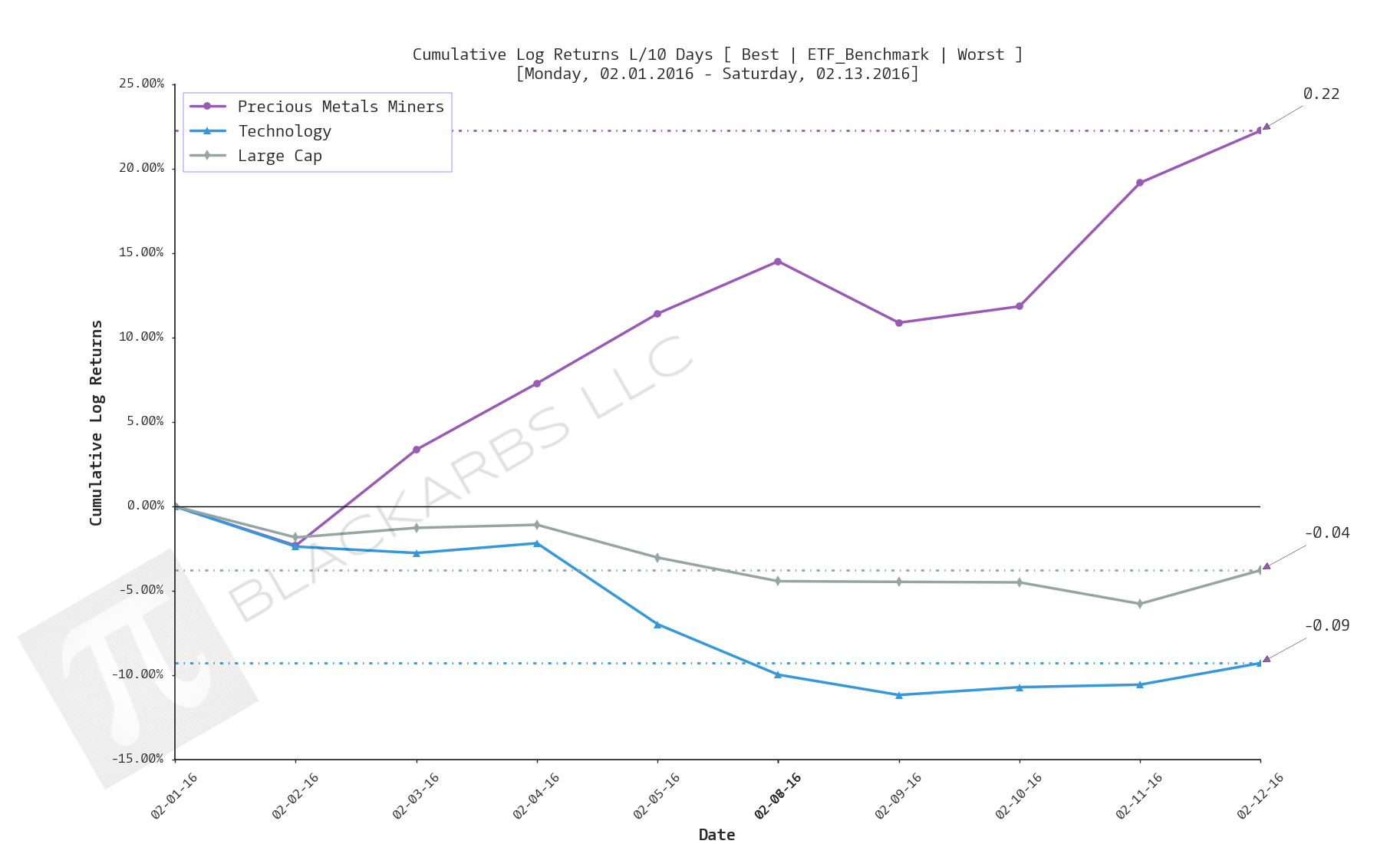

LAST 10 TRADING DAYS

Implied Cost of Capital Estimates:

To learn more about the Implied Cost of Capital see here.

CATEGORY AVERAGE ICC ESTIMATES

ALL ETF ICC ESTIMATES BY CATEGORY

Cumulative Return Tables:

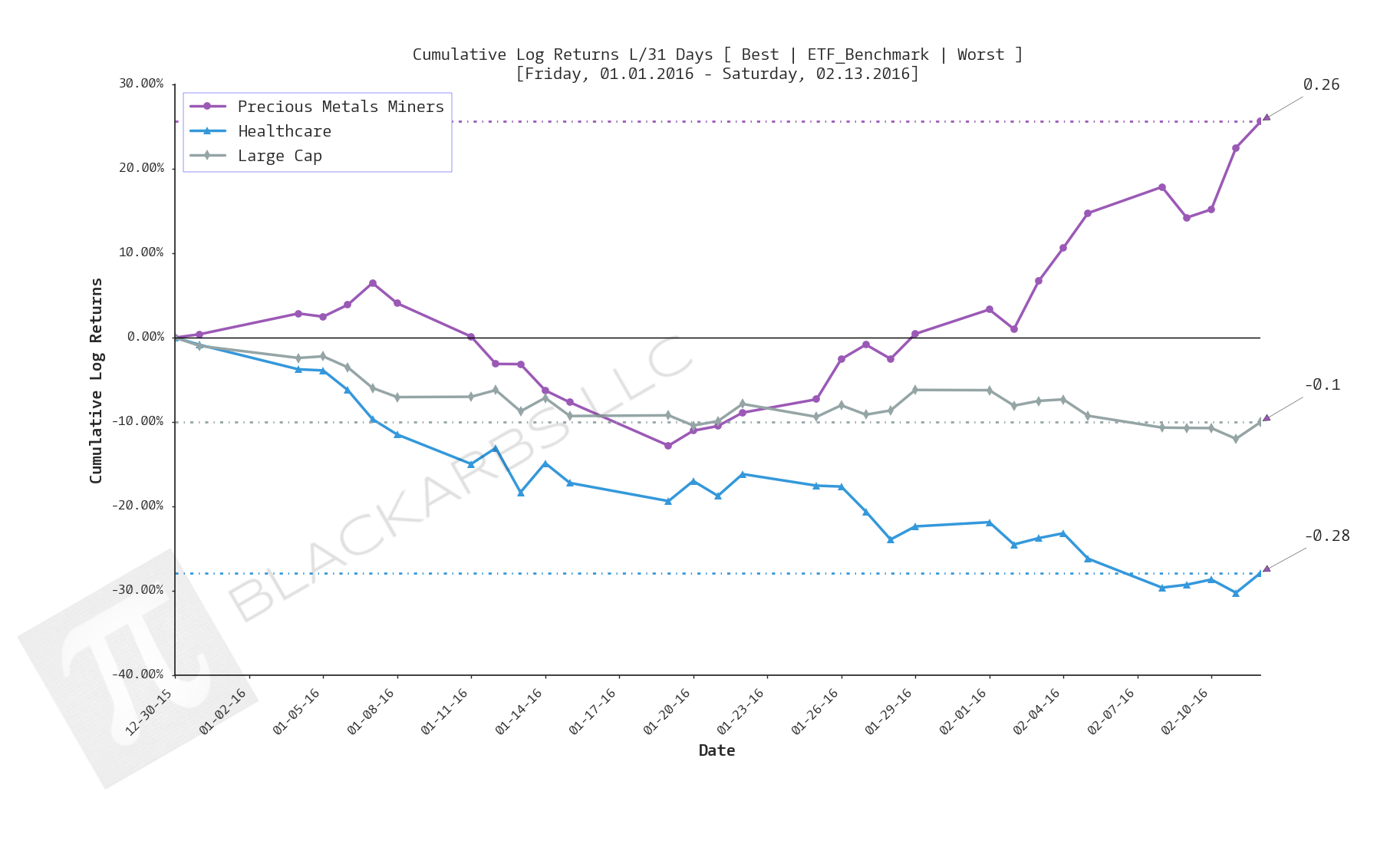

Notable Observations and Trends:

- Unfortunately not much has changed this week. Many of the themes I identified last week appear to be ongoing.

- Defensive positioning is still prevalent as Precious Metals Miners and Precious Metals have continued to outperform.

- The relative strength of the Emerging/Frontier and Consumer Discretionary composites over the last 21 and 10 days respectively is somewhat interesting. This gives the appearance of "Risk-On" but the other evidence implies investors should tread carefully.

- My current working theory is that T-Bonds provide a safe yield for global investors given the increasing popularity of NIRP. The corollary to that thesis is that the Precious Metals complex acts like a put on runaway Central Bank policy. It is likely that Precious Metals will continue to show relative strength until NIRP is removed from the Federal Reserve's policy discussion.